HKEX consulted widely with market participants – regulators, listed firms, potential issuers, law firms, brokers and industry associations – on how to create a robust, attractive new listing regime with a clear regulatory framework that would attract listings, connect investors to new opportunities and contribute to the healthy development of the market ecosystem here in Hong Kong.

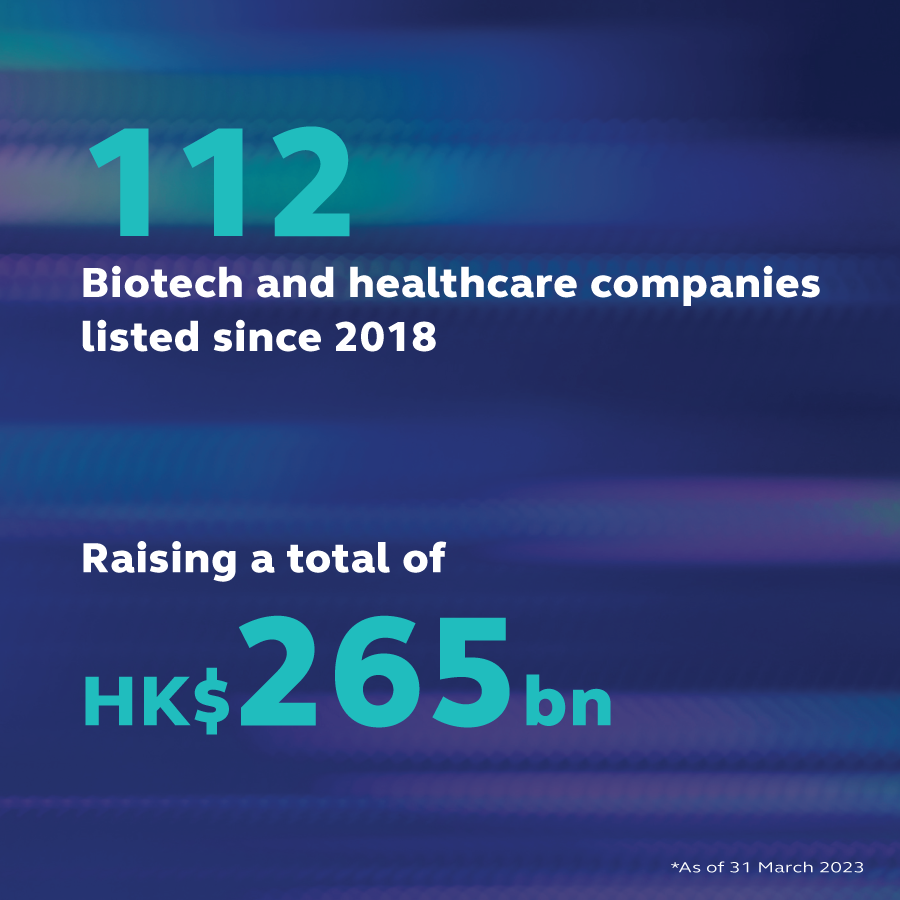

We delivered three new listing chapters in April 2018: 18A for pre-revenue biotech companies, 8A for weighted-voting rights issuers, and 19C for secondary listings of overseas issuers.

Since we implemented the new rules, 86 companies covered by chapters 18A, 19C and 8A have listed, raising HK$583.3billion, accounting for 41.2% of total IPO funds raised and 20.2% of total market capitalisation.

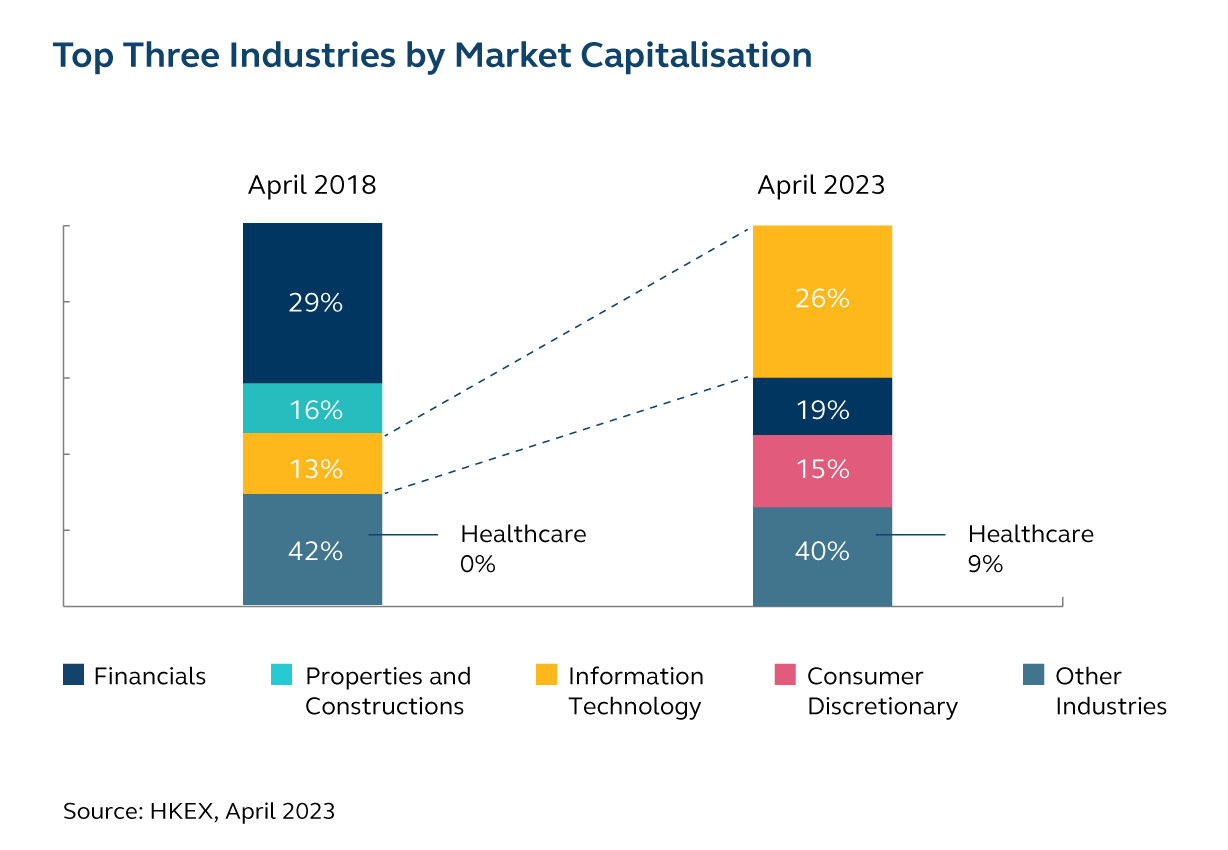

But it is the impact that the listing reforms have had on the market as a whole that has been the most far reaching: our markets have radically diversified, with many different companies in the healthcare and IT sectors listing in Hong Kong in the wake of the reforms. For example, following the listing of companies in the sector, the combined market cap of the two sectors has risen from HK$5.2 trillion at the end of 2018 to HK$12.2 trillion as of the end of March 2023.

260 new economy companies have listed in Hong Kong since the 2018 reforms, raising a total of HK$916.5 billion. The growing number of new economy companies listed in Hong Kong in turn, has led to an increase in the number and diversity of new economy-related investment products, a bigger investor base and an expansion of sell-side analyst coverage, growing the new economy ecosystem all around us.

The market is energised by the impact of the 2018 reforms: Hong Kong has become a world leader in the funding, growth, nurturing and development of new economy companies.

The desire to take this to the next step is strong, with the market supporting a continued diversification journey: there is demand to go further to connect capital with opportunities and find ways to enhance the attractiveness of our markets. Which is why we were especially pleased this year to launch our new Specialist Technology regime.